The Profit First approach, developed by Mike Michalowicz, is a cash management system that aims to prioritize profit above all else. Instead of the traditional accounting formula of Sales – Expenses = Profit, Profit First flips the equation to Sales – Profit = Expenses. This means that rather than waiting until the end of the year to see if there is any profit left, Profit First ensures that profit is taken out first, and then expenses are determined based on what is left.

This approach encourages businesses to allocate a certain percentage of their income towards profit from the very beginning. By prioritizing profit, businesses are forced to operate more efficiently and make better financial decisions. Profit First breaks down income into several designated accounts, including profit, owner’s pay, taxes, and operating expenses, ensuring that each aspect of the business is properly managed.

Comparison Between Traditional Accounting and Profit First Approach

In traditional accounting, businesses typically focus on growing their sales and revenue while keeping a close eye on expenses. The goal is often to reduce costs and increase the bottom line, but this approach may not always result in profitability. Profit First takes a different approach by putting profit at the forefront. By prioritizing profit, businesses are motivated to find ways to increase revenue and reduce unnecessary expenses, leading to sustainable profitability.

Unlike traditional accounting, Profit First provides a clear and actionable system to manage finances. By separating income into different accounts, businesses can easily track and allocate funds to specific purposes. This level of clarity and structure allows for better decision-making and financial planning. Profit First also promotes a more disciplined approach to financial management, ensuring that businesses stay on track and avoid overspending.

Reasons Your Business Needs the Profit First Approach

1. Ensuring profitability from the start

One of the key benefits of the Profit First approach is that it ensures profitability from the very beginning. By allocating a percentage of income towards profit, businesses are forced to prioritize their financial goals. This approach shifts the mindset of business owners and encourages them to focus on profit generation from the start. By making profit a priority, businesses can avoid the trap of constantly reinvesting all their earnings back into the business without ensuring sustainability.

2. Enhancing financial discipline

Profit First promotes a high degree of financial discipline. By separating income into different accounts and allocating funds accordingly, businesses gain a clearer understanding of their financial situation. This clarity allows for better decision-making and helps prevent overspending. With Profit First, businesses are encouraged to evaluate every expense and ensure that it aligns with their financial goals. This level of financial discipline sets businesses up for long-term success and sustainable growth.

3. Preventing unnecessary expenditure

Profit First encourages businesses to critically evaluate their expenses and eliminate unnecessary or wasteful spending. By analyzing each expense and considering its impact on profitability, businesses can make more informed decisions. This approach helps identify areas where costs can be reduced or eliminated altogether, freeing up resources to be allocated towards profit generation. By minimizing unnecessary expenditure, businesses can improve their bottom line and achieve higher levels of profitability.

4. Boosting cash flow management

Effective cash flow management is crucial for the success of any business. Profit First provides a structured system for managing cash flow and ensures that businesses always have the necessary funds available. By separating income into different accounts, businesses can allocate funds for various purposes, such as operating expenses, taxes, and profit. This approach ensures that businesses have enough cash on hand to cover their expenses while still generating profit. By optimizing cash flow management, businesses can maintain stability and weather financial challenges more effectively.

5. Driving innovation and efficiency

Profit First encourages businesses to find innovative ways to increase revenue and reduce expenses. By prioritizing profit, businesses are motivated to think outside the box and explore new opportunities for growth. This approach fosters a culture of innovation and encourages businesses to constantly seek ways to improve efficiency. With Profit First, businesses are empowered to focus on activities that drive profitability and eliminate those that do not. By aligning their efforts with their financial goals, businesses can maximize their resources and achieve sustainable growth.

Steps to Implementing the Profit First Approach in Your Business

1. Detailed steps on how to switch to a Profit First Approach

Implementing the Profit First approach in your business requires careful planning and execution. Here are the key steps to make the transition:

- Assess your current financial situation: Start by evaluating your current financial practices and understanding your income and expenses. This will give you a clear picture of where you stand and help you identify areas for improvement.

- Define your profit target: Determine the percentage of income you want to allocate towards profit. This will depend on your business goals and financial situation. It’s important to set a realistic target that aligns with your growth plans.

- Set up separate bank accounts: Open separate bank accounts for profit, owner’s pay, taxes, and operating expenses. These accounts will help you allocate funds properly and track your finances more effectively.

- Establish a rhythm: Create a system for regularly allocating funds to the different accounts. This can be done weekly, bi-weekly, or monthly, depending on your business needs. Stick to this rhythm to ensure consistency and maintain financial discipline.

- Monitor and adjust: Regularly review your financial performance and make adjustments as needed. Analyze your income and expenses to identify areas for improvement and make strategic decisions based on your financial goals.

- Tips on making the transition smooth and effective

Implementing the Profit First approach can be a significant change for your business. Here are some tips to make the transition smoother and more effective:

- Seek professional guidance: Consider working with a financial advisor or consultant who is familiar with the Profit First approach. They can provide valuable insights and help you navigate the transition process.

- Communicate with your team: Transparency and communication are key during this transition. Make sure your team understands the new financial system and their roles in implementing it. Encourage open dialogue and address any concerns or questions they may have.

- Educate yourself and your team: Invest time in learning about the Profit First approach and its concepts. Provide training and resources for your team to ensure everyone is on the same page and understands the new financial practices.

- Stay committed: Implementing the Profit First approach requires discipline and commitment. It may take time to adjust to the new system, but stay consistent and trust the process. Over time, you will start to see the benefits of prioritizing profit and making informed financial decisions.

Conclusion

The Profit First approach offers a fresh perspective on financial management that prioritizes profit from the very beginning. By flipping the traditional accounting equation, businesses can ensure profitability and drive success. This approach enhances financial discipline, prevents unnecessary expenditure, boosts cash flow management, and drives innovation and efficiency.

By following the steps outlined and embracing the Profit First approach, businesses can position themselves for long-term profitability and sustainable growth. So, why wait? Start implementing Profit First in your business today and reap the rewards of a more profitable future.

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

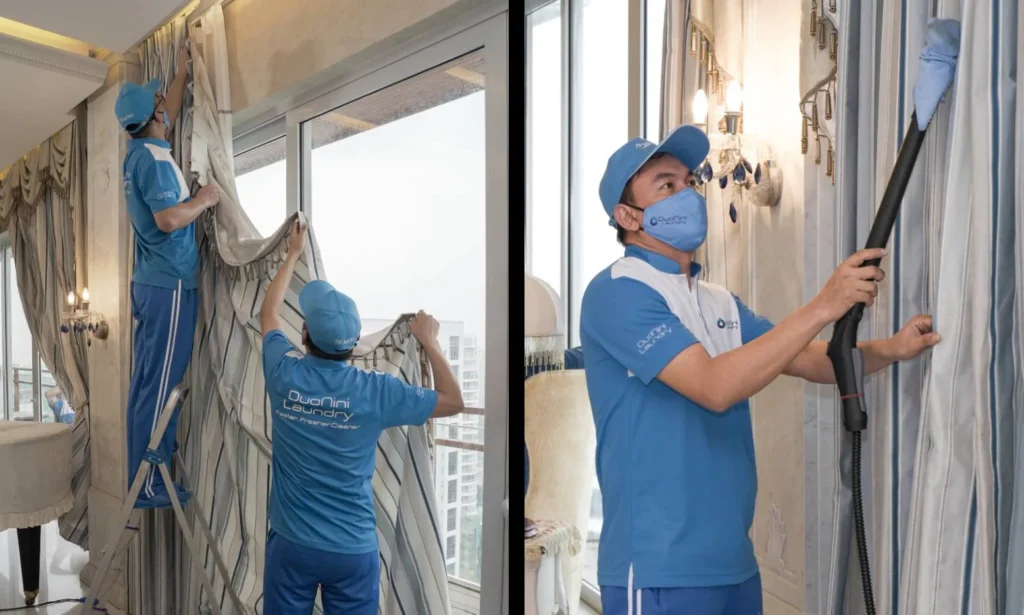

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

SEO for ChatGPT: Boost Your Brand in AI Responses

LLM-Native Software Architecture: Designing Products for Agents, Not Just Humans

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini