Digital transformation is no longer a strategic aspiration for financial institutions — it is a business imperative. Customers expect seamless, intuitive, and secure digital experiences across every touchpoint, from onboarding to daily transactions. At the same time, banks and credit unions face increasing regulatory pressure, legacy system complexity, and intense competition from fintechs and digital-native players.

In this context, digital banking solutions have become a cornerstone for institutions seeking to modernize operations without compromising stability or security. These solutions enable banks to launch new products faster, integrate with existing core systems, and deliver consistent user experiences across channels.

Rather than focusing solely on replacing core banking infrastructure, many institutions are prioritizing flexible, modular platforms that allow them to evolve incrementally. This approach reduces risk, accelerates time-to-market, and supports long-term scalability.

From legacy constraints to flexible digital ecosystems

Traditional banking systems were designed for stability, not speed. While they remain reliable for transaction processing, they often lack the agility required to respond to changing customer needs. Digital banking solutions bridge this gap by acting as an innovation layer between the core and the customer.

Modern platforms enable financial institutions to:

- Build and launch customer-facing applications faster

- Integrate seamlessly with legacy core banking systems

- Reuse components across multiple channels and products

- Scale performance securely as transaction volumes grow

This shift toward modular, composable architectures allows banks to modernize without disruptive “rip-and-replace” projects. Instead, innovation happens continuously and sustainably.

Customer experience as a competitive differentiator

Customer experience is often the deciding factor when users choose a financial provider. Digital-first consumers expect intuitive interfaces, fast response times, and personalized interactions — regardless of whether they are dealing with a global bank or a local credit union.

Leading digital banking solutions place user experience at the center of product design. High-performing customer apps consistently achieve strong ratings in app stores, reflecting how usability directly impacts adoption and engagement.

This focus on UX is not just about aesthetics. Well-designed digital experiences reduce friction, minimize user errors, and lower operational costs by decreasing reliance on branch and call center support.

Digital account opening as a key innovation driver

One of the most visible applications of digital banking solutions is digital account opening. Traditional onboarding processes often involve manual steps, in-branch visits, and lengthy approval cycles. These inefficiencies lead to abandoned applications and lost revenue.

Digital onboarding software transforms this experience by enabling:

- Online account opening from any device

- Integrated identity verification and compliance checks

- Automated workflows for faster approvals

- Seamless core banking integration

A well-designed onboarding process can reduce account opening times from weeks to minutes, significantly improving conversion rates.

A real-world example is DBS Bank, widely recognized for its digital leadership. Through continuous investment in digital onboarding and platform innovation, DBS has consistently ranked among the world’s best digital banks. According to DBS’s official site, digital services now account for the majority of customer interactions, demonstrating the impact of streamlined digital journeys.

Proven impact on speed, scale, and profitability

Beyond customer experience, digital banking solutions deliver measurable business results. Faster development cycles enable institutions to respond quickly to market opportunities, while modular architectures reduce long-term IT costs.

Key performance indicators often associated with mature digital platforms include:

- Faster deployment of new products and features

- Reduced IT backlog through reusable components

- Improved return on investment with shorter payback periods

- High transaction throughput without compromising security

For example, BBVA has publicly shared how its digital transformation strategy has driven efficiency and customer growth across multiple markets. The bank reports that a significant percentage of new customers now join through digital channels, underscoring the commercial value of digital onboarding and mobile-first services.

Security and governance at enterprise scale

Security remains a top priority for financial institutions adopting digital banking solutions. With billions of transactions processed annually, platforms must meet strict regulatory and operational standards.

Enterprise-grade solutions are designed with:

- End-to-end encryption and secure authentication

- Auditable workflows for compliance and governance

- High availability and resilience under peak demand

- Proven fraud prevention at scale

The ability to support tens of billions of transactions annually without fraud incidents is a critical benchmark for bank-grade platforms. This level of reliability enables institutions to innovate confidently while maintaining trust with regulators and customers alike.

Open integration and extensibility as strategic advantages

No financial institution operates in isolation. Modern banking ecosystems rely on integrations with payment providers, identity verification services, analytics platforms, and third-party fintech solutions.

Digital banking solutions that prioritize openness and extensibility allow banks to:

- Connect with hundreds of pre-integrated third-party services

- Adapt quickly to new regulatory or market requirements

- Expand functionality without rebuilding existing systems

This integration-friendly approach supports long-term innovation while protecting prior technology investments.

Supporting institutions of all sizes

While large global banks often dominate digital transformation headlines, community banks and credit unions face equally pressing challenges. Limited resources and smaller IT teams make flexibility and efficiency even more critical.

Scalable digital banking solutions empower institutions of all sizes to compete effectively by offering:

- Modular features that grow with the business

- Faster implementation without extensive custom development

- Expert guidance throughout the full solution lifecycle

This democratization of innovation enables smaller institutions to deliver experiences comparable to those of much larger competitors.

Continuous guidance and long-term success

Technology alone is not enough to drive successful transformation. Financial institutions benefit most when digital banking solutions are supported by continuous expert guidance and end-to-end lifecycle support.

From initial strategy and implementation to ongoing optimization, trusted industry specialists help ensure that platforms evolve in line with business goals and regulatory demands. This partnership-driven approach reduces risk and maximizes long-term value.

Looking ahead: the future of digital banking solutions

As customer expectations continue to rise, digital banking solutions will play an increasingly central role in financial services. Institutions that embrace flexible, scalable, and secure platforms will be better positioned to adapt to emerging technologies, regulatory changes, and new business models.

Rather than pursuing one-time transformation projects, leading banks are building future-ready digital ecosystems — designed to evolve continuously, integrate seamlessly, and deliver human-centered experiences at scale.

In a rapidly changing landscape, digital banking solutions are not just enabling innovation — they are defining the future of banking itself.

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

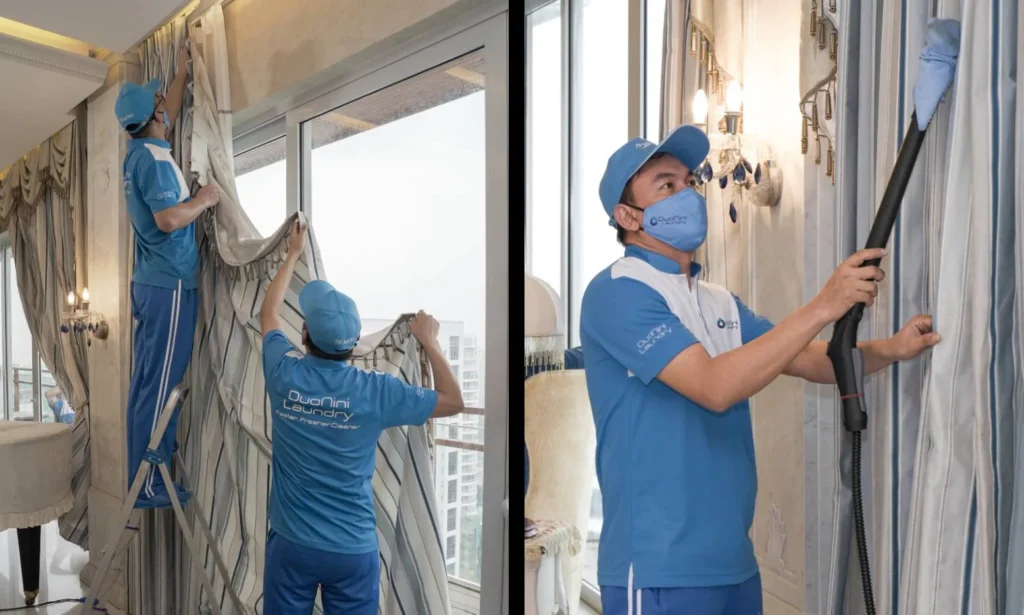

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

The Ultimate Guide to Family-Friendly Communities: Planning Your Family Vacation to Destin Florida

How Condensed Fonts Improve Packaging and Label Design

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini