Many people shy away from looking at their financial situation, thinking it’s too complicated or overwhelming. But imagine trying to drive without knowing where you’re going or what’s in front of you. That’s what managing your money is like if you don’t regularly check your financial statements. Financial statements are crucial tools for understanding where you stand financially, tracking progress toward your goals, and making informed decisions about your money. Whether you’re looking to manage a credit card to loan transfer or save for something big, reviewing your finances regularly can keep you on the right track.

The Role of Financial Statements

At their core, financial statements are simple reports that show your financial situation. These statements track your income, expenses, assets, liabilities, and equity. But, beyond just being a summary of your money, they help you make informed decisions. If you know how much you owe, how much you have in savings, and how much you spend every month, you can plan better, make smarter financial choices, and stay on track with your goals.

Financial statements typically include:

- Balance Sheet:This gives a snapshot of your financial situation at a specific point in time. It lists your assets (what you own) and liabilities (what you owe), and calculates your net worth.

- Income Statement:This shows your income and expenses over a period of time, such as a month or a year. It helps you understand whether you are living within your means.

- Cash Flow Statement:This tracks the movement of money in and out of your accounts, showing how well you’re managing cash to pay bills and save.

Why Regular Reviews Are Essential

You might think reviewing your finances only once in a while is enough, but in reality, it’s essential to track them regularly. Here’s why:

Tracking Progress on Goals

Financial statements help you keep track of your financial goals. Whether you’re saving for a vacation, paying down debt, or investing for retirement, your statements will show you how close you are to reaching those targets. For example, if you’re trying to pay off a loan, a balance sheet will help you track how much debt remains and how much progress you’ve made. If your goals aren’t progressing as planned, this information gives you the insight you need to adjust.

Making Timely Adjustments

Our financial situation changes all the time. You might get a raise, face an unexpected expense, or switch jobs. Financial statements help you make timely adjustments to your spending, saving, and investing to respond to these changes. For instance, if you realize your income has increased, you can use that information to put more toward your savings or to pay off high-interest debt.

Avoiding Surprises

When you track your finances regularly, you’re less likely to be surprised by bills, debts, or an unexpected expense. Regularly reviewing your financial statements keeps you aware of how much you have left after covering all your costs and what’s coming up next. This way, you won’t be caught off guard or end up in financial trouble.

How Financial Statements Help You Save Money

You might think that keeping track of your finances is all about numbers, but it’s actually about saving money in the long run. Here’s how:

Identifying Unnecessary Spending

When you see all your spending laid out on a financial statement, it’s easier to spot areas where you can cut back. Maybe you’re spending too much on subscriptions you don’t need or eating out more than you planned. Knowing exactly where your money is going can help you save by cutting out these extra costs.

Preventing Debt Build-Up

When you track your liabilities, you can make sure you’re not overextending yourself. If you’re considering a credit card to loan transfer, your financial statements will give you a clear picture of whether you can afford the new loan payments without pushing yourself into more debt. You can also check if your debt is getting out of control and take steps to fix it before it becomes a bigger problem.

Spotting Opportunities to Save and Invest

Financial statements can also highlight opportunities to grow your wealth. By seeing your income, expenses, and assets in one place, you might spot opportunities to invest or save more money. For instance, if you have more disposable income than you expected, you can decide to put that extra money into your retirement fund, stocks, or a high-interest savings account.

How to Get Started with Regular Financial Reviews

Now that we know why financial statements are important, how do you actually start reviewing them regularly? Here’s how:

Set a Schedule

The key to making this habit stick is consistency. Set aside time every month or quarter to sit down and look over your financial statements. This doesn’t have to be long—just 15 to 30 minutes to go through your balance sheet, income statement, and cash flow can be enough to keep you on track.

Use Tools and Apps

Many people find it easier to track finances using online tools or apps that automatically generate financial statements. Apps like Mint, YNAB (You Need a Budget), or even spreadsheets can help you organize your finances and make reviewing your statements easier.

Seek Help if Needed

If you’re not sure how to interpret your statements or if they seem overwhelming, consider seeking help from a financial advisor. They can help explain what the numbers mean and how you can make the most of your financial situation.

Read Also: Everything You Need to Know About Debt Consolidation Loans

Conclusion

Regularly reviewing your financial statements isn’t just a task—it’s a key part of taking control of your money and making smarter decisions. By tracking your progress toward goals, staying on top of your spending, and making timely adjustments, you’ll have a much clearer picture of your financial situation. Whether you’re paying off debt, saving for the future, or managing your day-to-day expenses, your financial statements will help you stay informed, avoid surprises, and make confident decisions about your money. So, start reviewing those statements today and take charge of your financial future!

How Sales Teams Increased Productivity with Parallel Dialers

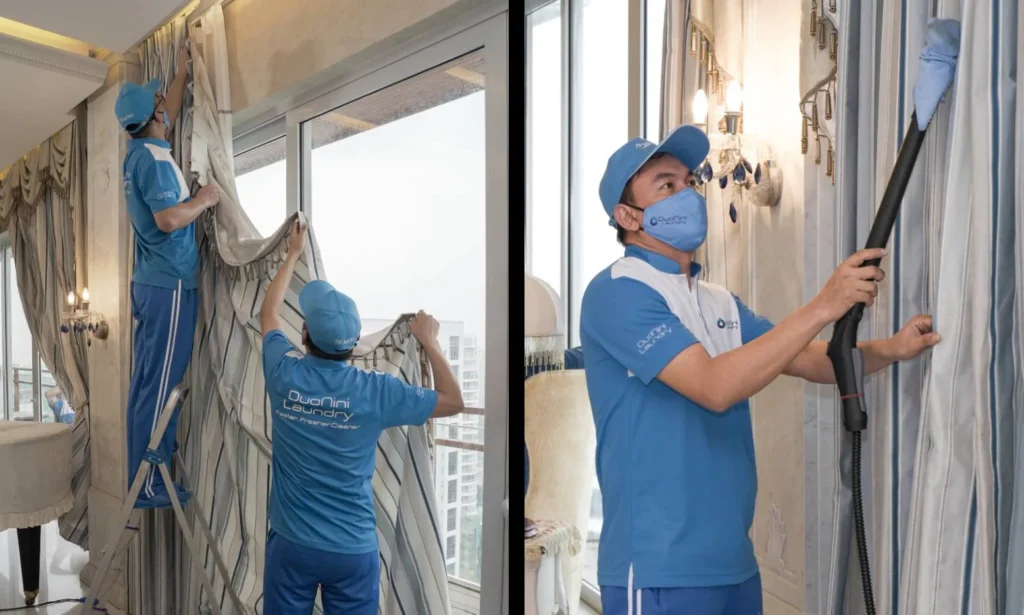

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

Brian Ferdinand of EverForward Trading Joins Forbes Finance Council, Expanding His Voice on Markets and Risk

The Complete Guide to Growing on Twitch: Should You Buy Twitch Followers?

How Technology Is Changing Addiction Recovery in the Digital Age.

How Sales Teams Increased Productivity with Parallel Dialers

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

Brian Ferdinand of EverForward Trading Joins Forbes Finance Council, Expanding His Voice on Markets and Risk