Applying for a vehicle loan is a straightforward process if you’re prepared with the right documentation. Whether you’re planning to finance a two-wheeler, a passenger car, or a commercial vehicle, most lenders require a standard set of documents to evaluate your eligibility. Understanding what’s needed ahead of time can speed up the approval process and help avoid unnecessary delays.

While a car loan and a broader auto loan serve similar purposes, some differences in documentation may arise depending on the type of vehicle and your profile. Here’s a detailed overview of the documents you need to successfully apply for and receive a vehicle loan.

Proof of Identity

Lenders need to confirm your identity to begin the loan approval process. Acceptable documents include Aadhaar card, PAN card, passport, voter ID, or driving licence. Whether you’re applying for a car loan or an auto loan, submitting a government-issued photo ID is mandatory.

Proof of Address

To validate your residence, you’ll need to provide a current address proof. You may submit one of the following: utility bills, rent agreement, passport, Aadhaar card, or driving licence. If you’re availing an auto loan for a commercial vehicle, lenders may also require a business address proof.

Income Proof

Your income determines your repayment capacity, and lenders assess this before approving any car loan or auto loan.

For salaried individuals, the common documents required include latest 3–6 months’ salary slips, last 6 months’ bank statements, and optionally Form 16 or latest ITR.

For self-employed individuals, lenders generally ask for income tax returns for the past 2–3 years, business bank account statements, business registration or GST filings, and audited financials if available.

If you’re applying for an auto loan to purchase a commercial vehicle, stronger financial documentation may be required, especially for higher loan amounts.

See also How to Plan a Last-Minute Holiday Trip with Instant Loan Support

Vehicle-Related Documents

This includes documents related to the vehicle you plan to purchase and is essential for both car loan and auto loan approvals. These include the proforma invoice or quotation from the dealer, registration certificate (RC), insurance details (if already available), and road tax receipt. For used vehicles, valuation reports and prior ownership records may also be needed.

Photographs and Application Form

You’ll need to submit recent passport-sized photographs along with a filled loan application form. Most lenders offer digital application options, especially for car loan applicants going through an authorised dealership. For auto loan products, particularly involving commercial vehicles, some in-person steps may still apply.

Credit Score and Existing Loan Information

Your credit score plays a vital role in loan approval. Lenders retrieve your report to assess financial behaviour. It’s also a good idea to declare any ongoing loans or EMIs. If you’re applying for a new car loan or auto loan, transparency about current liabilities helps build trust and avoids rejection due to existing obligations.

Additional Documents for Special Categories

Some applicants may need to provide additional paperwork. For women applicants, proof of income and ID in the woman’s name may unlock special interest rates. Agriculturists or non-salaried applicants may need to submit land records or income from agricultural produce. Businesses and partnerships will be asked for company PAN, incorporation certificate, and board resolutions authorising the purchase.

See also How to Meet Wedding Loan Eligibility and Get Fast Approval

Conclusion

Having your documents ready before applying for a car loan or auto loan significantly improves your chances of fast approval. Lenders need assurance of your identity, income, and ability to repay. When your paperwork is complete, the approval process becomes smoother and more efficient. Whether the goal is buying a personal vehicle or expanding a commercial fleet, the right documentation can make all the difference.

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

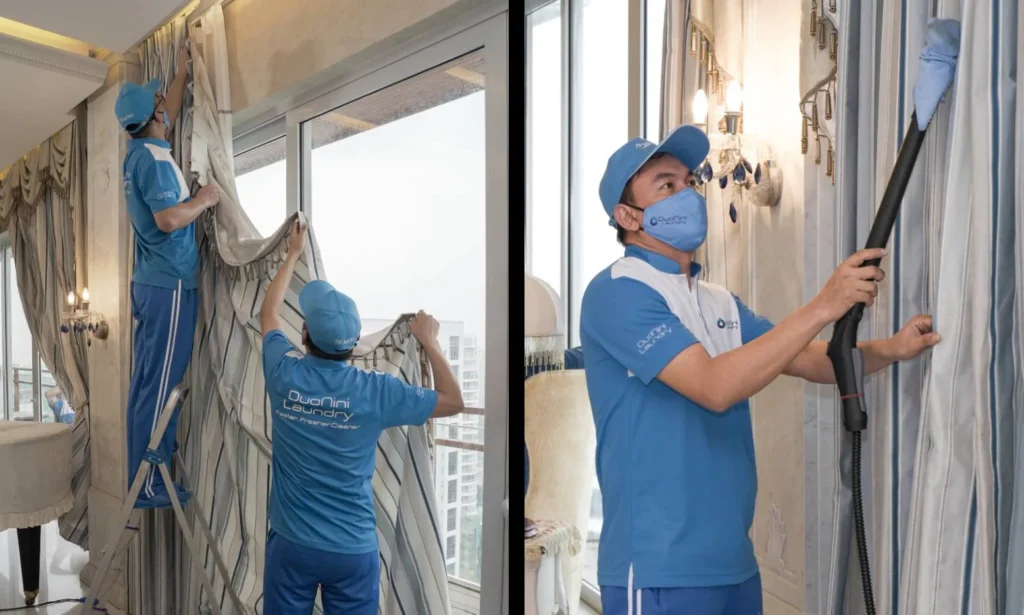

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

The Complete Guide to Growing on Twitch: Should You Buy Twitch Followers?

How Technology Is Changing Addiction Recovery in the Digital Age.

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini