All You Need to Know About High-Risk Credit Card Processing

High-risk credit card processing is the world of many businesses, especially those operating online. After all, the label “high risk” isn’t attached only to organizations operating in specific, fraud-susceptible industries but also to those that operate mainly on card-not-present transactions. But how is this type of processing different from the standard one? What do you need to know if your business is deemed “high risk” by financial institutions? You will learn that in this article – just read on!

What Is High-Risk Credit Card Processing?

High-risk credit card processing is a category reserved for businesses that, due to various factors, pose an elevated level of risk for payment processors. Factors contributing to this designation include a high likelihood of chargebacks, industry regulations, and the potential for fraudulent transactions.

Certain industries inherently carry a higher risk profile, leading to the need for specialized credit card processing. Examples include online gaming, travel services, and subscription-based businesses. Merchants operating in these sectors often face stricter scrutiny and may experience challenges obtaining traditional merchant accounts.

The same goes for businesses that were just started up. These are often labeled “high risk” due to the lack of history that could prove that it is otherwise.

The Challenges Faced by High-Risk Businesses

High-risk businesses face challenges and additional obstacles when compared to those utilizing traditional credit card processing. What are they in particular? Take a look below!

Increased Fees

One of the primary challenges for high-risk businesses is the higher processing fees imposed by payment processors. This is introduced to compensate for the potential fraud threats.

Stricter Underwriting Processes

High risk merchants undergo more stringent underwriting processes compared to their low-risk counterparts. This may include thorough background checks, financial scrutiny, and a detailed review of the business model. Be prepared for this scrutiny, as it can expedite the approval process.

Limitations

Some e-commerce platforms may only allow certain high-risk processors, which limits your range of choice. This, on the other hand, leads to you being reliant on two or three options, with limited possibility to negotiate the fees

Choosing the Right High-Risk Credit Card Processor

Knowing the challenges you’ll be faced with due to the high-risk credit card processing, let’s focus on choosing the right provider – at least in cases where the platform doesn’t restrict your choice. What to focus on? Mainly two things:

Specialization

Opting for a payment processor specializing in high-risk credit card processing is crucial. Preferably, you should select a provider that has experience in your particular industry. These providers are well-versed in the unique challenges faced by high-risk businesses and offer tailored solutions. Thoroughly research potential processors to ensure they have a proven track record in your industry.

Transparent Terms and Conditions

Before entering into any agreement, carefully review the terms and conditions outlined by the processor. Look for transparency regarding fees, contract terms, and any potential restrictions. Clear communication is key to a successful partnership.

The Takeaway

High-risk credit card processing might be an obligation to you, but it doesn’t mean you can’t make the right choice. By following the tips from our article, you will surely find a processor who is worth your investment and let your online business flourish!

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

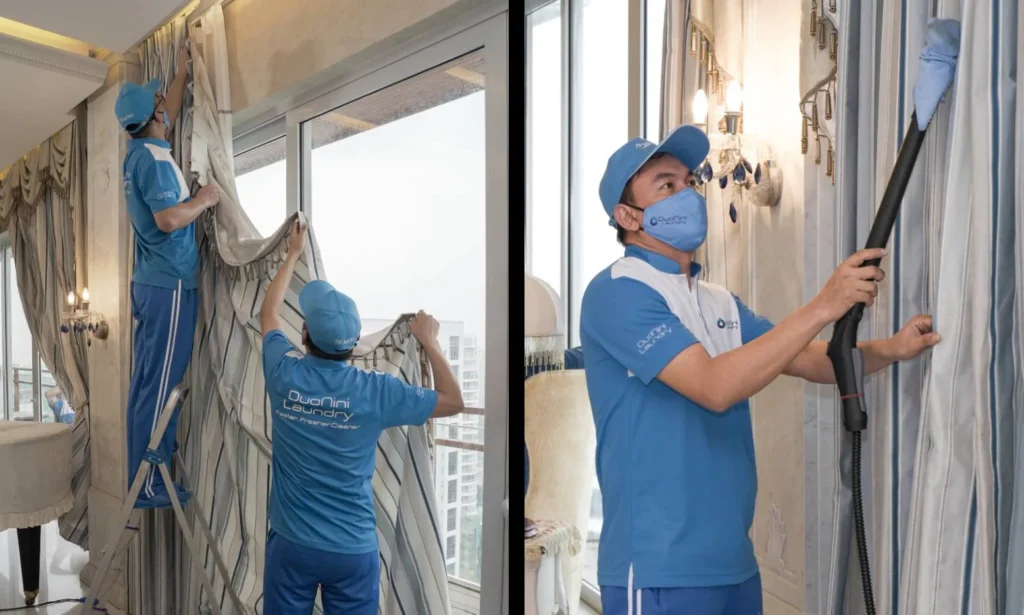

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

The Ultimate Guide to Family-Friendly Communities: Planning Your Family Vacation to Destin Florida

How Condensed Fonts Improve Packaging and Label Design

Why Retail Software Testing is Critical for Effective E-commerce Development?

How Sales Teams Increased Productivity with Parallel Dialers

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini