Diversify and Conquer: The Top 10 Index Funds for Your Mutual Funds Investments

Introduction:

In the ever-evolving landscape of investment opportunities, index fee ranges have emerged as a famous desire for traders searching out a various and occasional-fee technique to construct wealth. With the great array of alternatives available, choosing the right index fund may be a frightening mission. In this manual, we’re going to delve into the world of index price range, exploring the pinnacle 10 price range that provides a compelling mixture of universal overall performance, stability, and cost-effectiveness. Whether you are a pro investor or genuinely beginning to your financial adventure, these price ranges provide a strong basis on your mutual budget investments.

Vanguard Total Stock Market Index Fund (VTSAX):

Vanguard is renowned for its low-fee index fee variety, and VTSAX isn’t always an exception. This fund gives publicity to the whole U.S. Stock market, making it a remarkable preference for traders searching out large marketplace insurance. With a low price ratio, VTSAX is a price-powerful opportunity for long-term buyers.

Fidelity Total Market Index Fund (FSKAX):

Fidelity’s FSKAX is another top contender, presenting consumers a comprehensive view of the U.S. Inventory market. This fund aims to duplicate the overall performance of the total U.S. Stock marketplace, making it an appealing opportunity for the ones searching for a one of a kind investment with low charges.

iShares Core S&P 500 ETF (IVV):

If you’re particularly interested in massive-cap U.S. Stocks, the iShares Core S&P 500 ETF is a sturdy choice. This fund tracks the general overall performance of the S&P 500, comprising some of the most full-size agencies within the global. IVV gives a sincere manner to advantage publicity to blue-chip stocks.

Schwab U.S. Broad Market ETF (SCHB):

Charles Schwab’s SCHB is designed to track the overall performance of the Dow Jones U.S. Broad Stock Market Index. With a low fee ratio, this fund is a top notch alternative for investors looking for huge marketplace publicity at the same time as maintaining prices in check.

Vanguard Total Bond Market Index Fund (VBTLX):

Diversification isn’t always pretty. VBTLX from Vanguard focuses on bonds, offering consumers exposure to the complete U.S. Bond market. This fund is an important issue for those seeking to stabilise their portfolio with fixed-income securities.

iShares Russell 2000 ETF (IWM):

Investors with an urge for food for small-cap shares have to remember the iShares Russell 2000 ETF. This fund tracks the overall performance of the Russell 2000 Index, which incorporates smaller U.S. Businesses. IWM is an exquisite way to add a layer of diversification to your portfolio.

Vanguard FTSE All-World ex-U.S. ETF (VEU):

To make your horizons past the U.S. Marketplace, VEU from Vanguard gives exposure to international equities, aside from the USA. This global index fund offers diversification with the aid of which incorporates shares from developed and rising markets internationally.

Schwab International Equity ETF (SCHF):

Schwab’s SCHF is another noteworthy alternative for worldwide publicity. Tracking the FTSE Developed ex-U.S. Index, this fund includes shares from numerous advanced international locations, imparting customers a well-rounded technique to international diversification.

iShares Select Dividend ETF (DVY):

Investors trying to find income via dividends should discover DVY. This fund makes a speciality of excessive-dividend U.S. Shares, supplying a manner to capture income on the equal time as making the maximum of the capability for inventory appreciation.

Vanguard Real Estate ETF (VNQ):

Adding a touch of real property on your portfolio is feasible with VNQ. This Vanguard fund tracks the overall overall performance of the MSCI U.S. Investable Market Real Estate 25/50 Index, presenting exposure to the actual belongings sector without the trouble of belongings management.

Check: Mutual Funds Investments

Conclusion:

As you embark on your journey to build wealth via mutual rate range investments, choosing the proper index finances is critical. The budget referred to above represents a various range of funding opportunities, masking U.S. And international markets, stocks, bonds, and real property. Remember to consider your funding goals, chance tolerance, and time horizon whilst making selections.

In a world in which prices can eat into your returns, the one’s index finances stand out for his or her low charge ratios, making them appropriate for every beginner and professional trader. Diversifying your portfolio with a mixture of these top-appearing best index funds can provide a solid basis for lengthy-term monetary achievement. Whether you’re seeking out a boom, earnings, or a balance of each, those price varieties offer the electricity to tailor your funding strategy to meet your specific dreams. Happy making an investment!

How Sales Teams Increased Productivity with Parallel Dialers

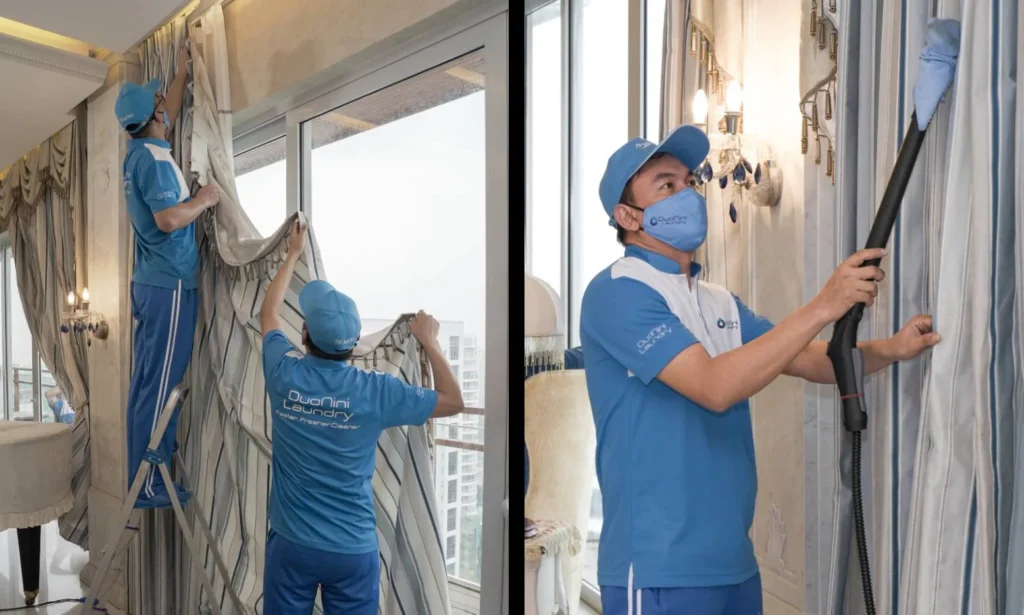

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

Brian Ferdinand of EverForward Trading Joins Forbes Finance Council, Expanding His Voice on Markets and Risk

How Technology Is Changing Addiction Recovery in the Digital Age.

Our First Winter Trip to Aspen — And the Decision That Made It Stress-Free

How Sales Teams Increased Productivity with Parallel Dialers

Curtain Dry Cleaning and Leather Sofa Cleaning – Reliable Care by Duo Nini

Brian Ferdinand of EverForward Trading Joins Forbes Finance Council, Expanding His Voice on Markets and Risk